Some Known Questions About Dubai Company Expert Services.

Wiki Article

The Single Strategy To Use For Dubai Company Expert Services

Table of ContentsDubai Company Expert Services Can Be Fun For AnyoneThe 15-Second Trick For Dubai Company Expert ServicesTop Guidelines Of Dubai Company Expert Services8 Simple Techniques For Dubai Company Expert ServicesThe Greatest Guide To Dubai Company Expert ServicesSome Known Incorrect Statements About Dubai Company Expert Services Unknown Facts About Dubai Company Expert Services

The individual income tax obligation rate is also low as contrasted to other nations. One of the most significant advantages of registering a firm in Singapore is that you are not called for to pay tax obligations on capital gains.

It is very easy to start company from Singapore to throughout the globe.

The startups acknowledged via the Startup India initiative are supplied enough benefits for starting their own service in India. Based on the Start-up India Activity plan, the followings conditions need to be met in order to be qualified as Start-up: Being incorporated or signed up in India as much as 10 years from its day of consolidation.

The Definitive Guide for Dubai Company Expert Services

100 crore. The government of India has actually launched a mobile app and also a website for very easy enrollment for startups. Any individual thinking about setting up a startup can load up a on the internet site as well as upload particular records. The entire process is entirely on-line. The federal government likewise provides checklists of facilitators of licenses as well as hallmarks.The government will certainly bear all facilitator charges and also the startup will certainly bear just the legal fees. They will certainly take pleasure in 80% A is set-up by government to supply funds to the start-ups as financial backing. The government is additionally offering warranty to the loan providers to urge banks and also various other monetary institutions for supplying endeavor funding.

This will assist start-ups to attract even more financiers. Hereafter plan, the startups will certainly have a choice to choose between the VCs, offering them the freedom to choose their capitalists. In case of departure A start-up can shut its service within 90 days from the day of application of ending up The government has actually suggested to hold 2 start-up fests each year both nationally as well as worldwide to enable the different stakeholders of a startup to satisfy.

Facts About Dubai Company Expert Services Uncovered

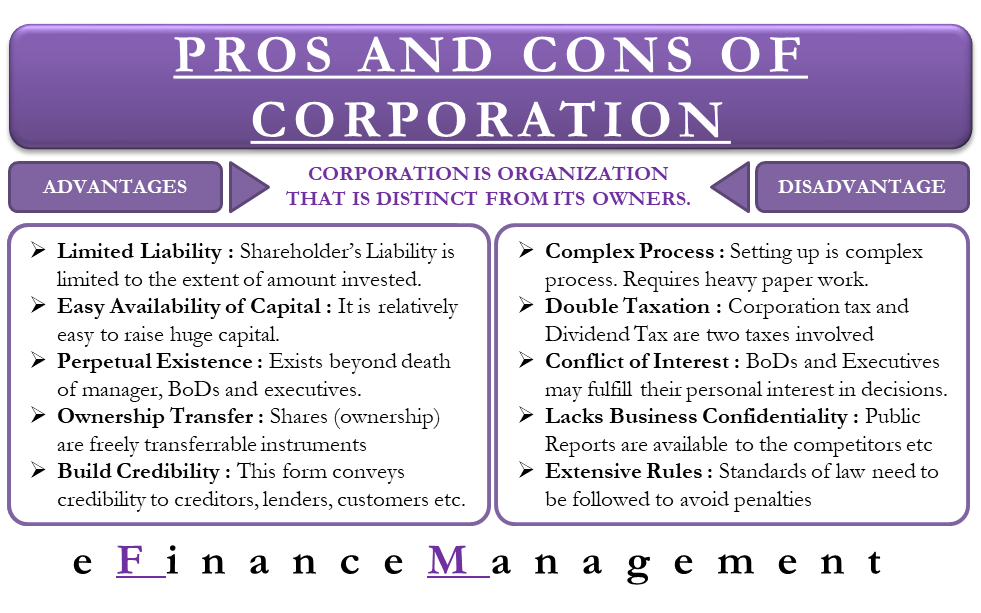

Restricted business can be a terrific choice for numerous home capitalists yet they're not appropriate for everybody. Some landlords may actually be better off having property in their personal name. We'll cover the benefits and drawbacks of limited companies, to aid you determine if a limited firm is the right alternative for your property investment service.As a business director, you have the adaptability to pick what to do with the earnings. You can purchase additional residential or commercial properties, save right into a tax-efficient pension plan or pay out the profit purposefully utilizing dividends. This adaptability can help with your individual tax obligation planning contrasted to directly owned residential properties. You can find out more regarding tax obligation for residential property financiers in our expert-authored guide, Intro to Real Estate Tax.

If your profits are going up, this is certainly something you should keep a close eye on and also you may want to consider a minimal firm. Dubai Company Expert Services. As a supervisor of a firm, you'll lawfully be required to maintain accurate company and also economic records and also submit the proper accounts as well as returns to Companies Residence as well as HMRC.

Dubai Company Expert Services Things To Know Before You Buy

That's precisely what we do below at Provestor: we're a You'll need to budget plan around 1000 a year for a limited firm accountant and also see to it that the tax advantages of a limited business surpass this additional price. Something that not lots of people discuss is dual taxes. In a minimal business, you pay corporation tax on your profits. Dubai Company Expert Services.It's worth discovering a professional limited company mortgage broker who can find the best offer for you. Grind the numbers or chat to a specialist to make certain that the tax obligation cost savings surpass the added prices of a restricted company.

A check that personal limited company is a kind of business that has limited liability and also shares that are not easily transferable. The owners' or members' assets are hence shielded in case of organization failure. Still, it should be worried, this protection just relates to their shareholdings - any cash owed by the service continues to be.

Unknown Facts About Dubai Company Expert Services

Nevertheless, one significant drawback for brand-new organizations is that establishing an exclusive restricted firm can be complicated and also expensive. To shield themselves from liability, business need to follow particular rules when integrating, consisting of declaring write-ups of organization with Business Home within 14 days of consolidation as well as the annual confirmation statement.

The most usual are Sole Trader, Partnership, and Exclusive Minimal Company. Limited Liability The most substantial benefit of an exclusive minimal business is that the owners have restricted liability - Dubai Company Expert Services.

If the firm declares bankruptcy, the proprietors are just accountable for the amount they have actually purchased the company. Any company's cash remains with the firm and does not drop on the owners' shoulders. This can be a considerable benefit for brand-new organizations as it safeguards their possessions from potential organization failures.

Dubai Company Expert Services - Questions

Tax Reliable Private limited companies are tax obligation effective as they can claim corporation tax relief on their revenues. This can be a significant saving for services and boost earnings. On top of that, private restricted firms can pay returns to their shareholders, which are also tired at a reduced rate. Furthermore, there are numerous various other tax obligation benefits available to firms, such as capital allowances as well as R&D tax credits.

This implies that the firm can contract with various other businesses and also people as well more tips here as is responsible for its financial obligations. In other words, lenders can not seek direct payment from the individual possessions of business's proprietors in situation of financial debts or personal bankruptcy in behalf of business. The only money that can be declared directly in the firm's responsibilities and not those sustained by its proprietors in behalf of the company is shareholders.

This can be valuable for local business that do not have the moment or resources to handle all the administrative jobs themselves. Flexible Administration Framework Personal minimal business are popular for sole investors or small organizations that do not have the resources to establish Recommended Site a public limited business. This can be beneficial for firms who desire to keep control of their procedures within a small group of individuals.

Rumored Buzz on Dubai Company Expert Services

This is since exclusive minimal business are extra reliable and also well-known than single traders or collaborations. On top of that, personal minimal firms frequently have their web site and also letterhead, giving clients as well as vendors a feeling of count on business. Defense From Creditors As mentioned previously, among the crucial advantages of a personal restricted business is that it supplies defense from financial institutions.If the company enters into financial obligation or personal bankruptcy, lenders can not look for direct payment from the individual assets of business's owners. This can be crucial security for the shareholders and supervisors as it limits their liability. This means that if the business declares bankruptcy, the proprietors are not personally liable for any kind of money owed by the business.

Report this wiki page